Leave a Comment:

8 comments

Wonder whether our rich gov and MPs have invest in this product. If people like us heartlanders from housewives to bankers invested, I am sure some of them did. I believe this item will be discuss soon. Let’s watch the CNA tonight and see how the Ministry of $ response. Good thing is there will not be any request for pay increase this year.

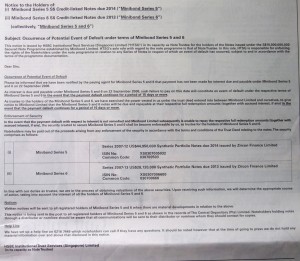

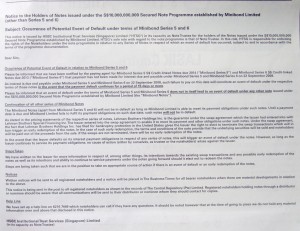

I am sure HSBC and DBS have called Minibond Pte Ltd on whether they are defaulting interest payment of DBS notes 5 and 6 in 15 days time and other Notes. So why has to wait for the 15 days period of each note. Why don’t just get Minibond Pte Ltd declare early redemption outright since Lehman is bankrupt or is there still hope? Who can tell us?

This should be what the FIs and MAS should be doing to speed up the immediate concern then reacting to situations.

Where are the answers to what’s going to happen to our principal? Cannot be “wait”, “we are contacting” or “action will be taken 15 days later after interest default as according to the contract”

Wait till when they visit and realize Minibond Pte Ltd is a sign outside a public toilet in Cayman Islands then it will be real embrassing…..

Regards,

ReplyHere is another website that talk about Lehman Bros Minibond and compare MAS with HK MAS approachs to investors concerns.

http://singaporemind.blogspot.com/2008/09/in-hk-govt-seeks-to-help-lehman.html

Do anyone think that bring this up to an MP would be useful to raise in govt? we are talking about a 1/2 billion dollars losses for minibond holders and at least another 1/2 billion dollars for HN and what-not.

ReplyIf the coupond is still not paid after the grace period. As you say HSBC trust will sell the underlying securities and return proceeds to the note holders. I suppose this means that we will not get back our original capital outlay. They will sell the securities at the market price which should have been beaten down because of this crisis. I am right?

ReplyYou should start giving the idea to HSBC Trust not to sell the securities but transfer to your name. Then you hold on these securities and continue getting the coupon and pricnipal (they have not deafaulted) or even hope of a market recovery in the future so that you can sell it off at more reasonable pricees.

Reply…That is only if the securities I’m talking abour are not CLNs that are now worthless.

ReplyRead from the Barclays website that they have acquired Lehman

In such case will the minibond and DBS high notes5 investor get back their money?

ReplyJane,

The DBS High Notes 5 has a credit default event. Since Lehman had gone into bankruptcy, nothing can change that fact and the investors will have to bear the losses. It is likely they will get back very little.

For the minibond series, a lot will depend on the value of the underlying securities if the notes are liquidated.

ReplyThanks for the reply.

How about Merill Lynch situation? They did not announce bankruptcy like Lehman as BOA bought them over. I’ve bought their Jubilee notes (before came about your blog), the first payout is Oct08 and I’m wondering will I get it??