Leave a Comment:

8 comments

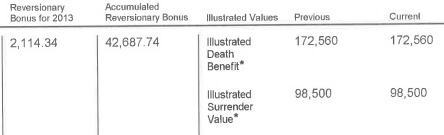

Only over the past 1 year, I have been trying to keep track of these insurance statements. I am coming to the conclusion that such statements dont add much value to better inform its clients and most times are confusing and misleading.

In my case, there is a endowment policy which I had stopped paying premiums years ago (ie paid up) but I am still being sent illustrated values projected on the assumption that premiums are being paid for the next 20yrs. How is that relevant when I am no longer paying any premium ?

I agree that Insurers should provide the Current Surrender Value and Current Death Benefit.

Dear BC,

Are you referring to a Whole Life plan or an endowment plan?

ReplyMore than 20yrs ago when I just stepped out to work, I bought a whole life 80k policy. That time 80k was still quite a lot of money and the annual premium was within my reach. Also, the agent told me many years down the line, the payout my beneficiaries would get would grow and surely more than 80k. I signed on the dotted line and am still paying it.

Whether my decision made that time was right or wrong, there is no way to undo it.

But I will never buy a whole life policy again.

The bigger problem is the lousy value of this example “insurance”.

This is for a $50K wholelife insurance. What can $50K protect? Maybe just enough for 2 years of living for your remaining spouse & children if they live like foreign workers.

As a savings vehicle, it also fails, having severe limitations and high liabilities.

For the same price that this person is paying for this $50K wholelife, he should get a term insurance of a few hundred thousands that can cover his dependents when they need him most.

My Mom has the GE Whole-Life policy and the bonus statement was exactly similar to the one you posted. I was surprised why the surrender value was so high, until I saw that it was a projected value.

Really very misleading. Is GE out to mislead policy holders?

Dear James,

GE replied and said that it was industry practice.

http://www.straitstimes.com/premium/forum-letters/story/bonus-statement-industry-practice-20140628

ReplyThanks for sharing my concern. I sincerely hope to see a more useful bonus statement that is beneficial to all policyholders

ReplyI chuck my insurance statements aside.

Nothing is guaranteed (unless those statements that come with the word guaranteed) until one receives the payout.

Insurance agents always tell me “though projected values, based on past experience or track records, these values are highly reliable”. I take this as a pinch of salt.