Leave a Comment:

48 comments

My comment might seem way delayed but in any case, i just want to say that I like your post! And I totally appreciate what you have posted.

Over time, I’ve come to appreciate the purpose of each type of plan, and it really depends on Individual needs. And I dare say that most who write off Whole Life do not really have a good understanding of how this product class may fit within their finanical portfolio. A lot is based on forum postings and people tend to focus on negativity and in the end miss the objectivity part of the discussion.

Whole Life may not be suitable for some, but it is nonetheless a great asset class for many. And this has got nothing to do with commission. commission only complicates in skewing the biasness of peoples’ judgment, be it the buyer or the seller.

ReplyI feel term plans are much better.

I found Aviva’s i-life the best term plan currently in India.

Duh Watchman

1)I feel sorry for you that you have an impeccable bias towards insurance people due to your impeccable narrow mindset.

2)You jump to people’s throat and assume that I am selling the point of buying WL to pay for credit card. Thats is totally “DUH”!

3)NO. that is not the point I am trying to get across. I am trying to tell you that 5-8% per annum IS NOT Blood sucking like 2% a month(as charged by some banks)! This is a FACT and truth and whether you can accept the truth or not is another story of course.

4)I am giving an example and comparison that if someone has a WL for a long time that has accumulated cash value, s/he can borrow the cash value to repay his or her credit card debt(if she or he is paying minimum payment) or any outstanding debt that takes more than 1% per month!

5)I am not talking about buying WL now and hoping to use it to pay for credit card debt (not unless the person becomes a deceased)!

6)Pls do not jump to the conclusion that the adviser holds 100% responsibilities that the client will 100% listen and apply the advise given. Client as an individual has the right to make their choice at the end of the day.

7) Based on (1) and (6),I do hope that you think twice of telling people (especially those do not have any insurance) all the craps that you have been talking unless you have a perfect solution for them because when something happen to that individual(and they are not covered) because of your craps, another family suffers!

Replyhi,

I have been reading all the posts and find some people especially WM, an “irritant”.

WM, pls get your facts right before posting on public and misleading all other innocent victims.

btw, WM, you sound like a Mr Tan I know. If you are, pls redirect your efforts and time into other areas such as returning the full commissions to your clients.

ReplyThat is possible provided you keep the insurance coverage to the minimum and with the right fund and for a longer time. It is better (comparative)than WLs in many ways but watch out when you get old.

ReplyHi,

Just FYI I do know of someone who has a regular ilp for more than 15 years. her latest statement show that her cash values now is more than the 9% projected in the bi.

ReplyAndy,

you must be some insurance agent who cannot see the role of financial adviser because you are a salesman. Salesmen selll and they don’t advise or plan and that is why to them investing falls on the individual. Advisers coach and are life coaches but not salesmen like insurance agents who abandon their victims after conning them of sale of WL….To think that you buy WL just in case you have to pay your credit card debt is very interesting. An interesting salesman ruse to sell WL. Wonder how many have fallen victim to your interesting ruse?

“Duh” Watchman

I think you are the one who is confused!!!

OMG, “Borrow” just like borrow ffom bank, borrow from credit card. Ofcourse there is interest charge.

I encourage you to check from all the insurance companies , be it 8% or 6% or 5.5%. You forget to mention it PER ANNUM. So when you divide 8% by 12months, it is like 0.666666% per month on the loan. PLS compare to credit card like 2% per month!

If those realized that they have outstanding credit card loan pls borrow money from your insurance cash value to settle it. You are better off paying your insurance loan than credit card loan!!

SO…IT IS not Ah long interest!!!It is helping you to settle the AH long interest!!

You see…. everything blame on the agent again. Not all agents sell financial products. If a customer decides to buy term from agent and invests the difference from different financial institution, it is not the agent’s responsibilities to ensure that the customers die die will invest the difference or earn money.

Dont push responsibilities to the wrong group of people!

Pls be balance!!

Andy,

you confused ,lah. From your posting , you no know about bTITD or WL , hor. You talk term no cash value; you talk can borrow from WL but you no talk that borrow must pay 8% or 6% or 5.5% Ah Long interest..You no talk that invest the difference is agent help to invest and not the customer, right? So who must be savvy? the agent must be savvy, lah. That is why agent recommend BtId, hor.

Hi dear all

Actually The uproar of buying WL ideas came from those who wanted to sell their investment but people have their money committd to insurance.

So…. bTiTd came up lah!

Ah yeah… if you are really investment savvy, yes bTiTd lo.

Make sure you remember to pay your term every yr so no lapsed. Make sure you dont lose all the money then want to borrow some money from your Term which has no cash value lo.

If not the investment savvy one you sell them term and tell them to invest the difference. They either invest or spend the money. If they invest, they make money, good. If lose then they say.. ah yeah, put in WL still can borrow some money, take some dividend. If they didnt invest and spend the money then after 20yrs their relatives surrender WL got money then they blame you how come dont sell them WL but term which is after 20 yrs nothing happen no money….

So… i agree with someone’s saying : The best investment is not the one that give you the highest return but to provide you with the money when you really need it.

So balance everything lo. Everything buys a bit lo…Make everyone happy, every advisor also happen, spread the economy mah…

ReplyThank you, Lioninvestor, Watchman and Shanne.

I really overlooked the high sales charge (5%) when the premium I paid is used to buy the fund… I have paid the full 1st year premium in March so I guess it is too late to do anything now. If I surrender the policy now, I basically get back nothing.

Anyway, thank you for the advice.

ReplyHi Lioninvestor.

I read with great interest your current post and the subsequent comments that followed your post. Whether positively or negatively most of them were extremely interesting…

I am currently doing a financial project (not school related nor to do with any organisation) and am looking into the topic of insurance esp the main one’s such as term and whole life. You seemed to have quite abit of indepth views in the topic and I am wondering if you may care to provide abit of assistance in my project. I suppose you can see my email address so do drop me a reply if you are interested. Thanks

Will be bookmarking your site for further articles!

ReplyAlex,

Oops, bad choice. No no for regular premium ILP. Go and look at the effect of deduction of your policy. If you hold it long enough, about half or more of your money will go to the insurer due to the various fees being charged, mainly the Annual Management Charge (AMC), initial heavy charges, bid-ask spread, etc. Like what Martin said, all else being equal, you get higher returns by going direct. For example, Aviva charges 2.4% p.a. of AMC for DBS Shenton Income, but it’s only 1% p.a. if you buy direct from DBS AM. Just an example ok. Of course noone will RSP a bond fund. That’s why if you do a performance comparison of ILP fund and the underlying UT, you will notice that the latter will surely beat the ILP by > 1.5% or more per year. Compound it over say 20 or 30 years it translates into a HUGE amount.

Do not believe that it will be either 5% or 9% p.a. Just like what David had suggested, the BI should instead show another set of -5% or -9% p.a.

Lastly, like I mentioned earlier and I wish to say this for one last time: DCA aka RSP (if left unmonitored like in regular premium ILPs) doesnt work over the long run. DCA only works, for example, for the short term, when market prices are low or falling and then subsequently rebound. Investment is not as simple as some as-perts put it eg DCA into low cost funds or ETFs will do. Otherwise, CFP & CFA holders like me will not be needed. Oops.. Better be careful of what I can, later kena Watched and Bashed.. Garrett helps me!!! 🙂

ReplyHi, Alex,

both regular ILPs and WL are con products but between them regular ILP is better.

The salesmen who peddle WL will condemn regular ILPs as risky, mortality cost becomes a bomb at old age and so forth but unknown to the WL advocates WL has a big bomb too but not transparent or disclosed to their customers .The salesmen who peddle regular ILPs claim you can have high sum assured for little premium whereas WL is rigid in favour of the insurer.

The truth of this running battle is that the kettles are calling the pots black. Why are they fighting? A lot is at stake…the commission. Consumers beware…both are rip off.

The best strategy is BTITR…separate your protection and saving and you will not have the problems of the above pots and kettles.

I just purchased a regular premium ILP before I came across this website. Can somebody highlight to me what is so bad about regular premium ILP as compared to WL?

I did my own comparison for WL and regular premium ILP before making the decision. To me , ILP allows me to get a higher sum assured for the same monthly premium. Also, the cost of distribution (commission to agent) for ILP is lower than that of a WL for the same premium.

The bad thing about ILP in my understanding is taking up of the investment risk and the need to terminate the policy at old age as the insurance charges will be too high. I have no problem with this but is there anything else I overlook?

Thank you in advance for any advice.

ReplyHi Alex,

If you are going to take on the investment risk, you would (in most cases) be better off buying a term and investing the rest. That gives you greater control and flexibility in terms of both the insurance and investment element.

ReplyMartin,

i am engaging in an academic debate between regular ILPs and WL. As I said I didn’t like both but between these 2 evils I preferred ILPs and I gave my reasons why regular ILPs are better than WL. In fact I advised consumers against buying them.

Then comes this joker who shoots off his hip to attack me. I am only defending against a CFP and CFA.

Another crap of yours.. unbefitting someone who claims to have CFP and CFA… you sound more like one of those self styled financial gurus who con people with strange theories. I think the only ‘qualifications you have are those tikam tikam certs in insurance and ilps.My advice is don’t tikam tikam away your customers’ financial future.

Did you say DCA won’t work in a bull market and only during the bear? I think you are a technician, crystal ball gazer who fool customers with your predictive ability to know when the booms and busts start and end. I find you give advice freely. If it is too good to be true it is. Please set up stall at Waterloo Street and make living by offering your investment tips, ok? You are the hind sight expert who cannot see what is over the bonnet.

Please keep your charts. I am not impressed by this rubbish.It is con job.

Please ,you are the one who is bringing disrepute to the profession . You haven’t rebutted my regular ilps points I touted.

I already expected this kind of response from you. You are so predictable..

As you’ve admitted that you ain’t a practitioner and do not have access to the necessary info and data, you’re forgiven for talking nonsense without grounds.

Any competent investment advisor would tell you that DCA is a crap strategy invented by some financial genius to fool man-in-the-street and half-baked expert like (err..). If financial and investment planning is so easy (pay $12 study the crap book then thought can become as-pert and get financial freedom), then I’d not have taken the CFP and CFA lor.

It won’t surprise me that you don’t know that bull markets usually last much much longer that bears! In the past two decades, the emerging markets’ average length of a bull market is over 24 months while the bear market only lasted for around 7 months. Remember the past bull run? It started in end 2002 and ended in Oct 2007. That’s a long, continuos 5 years of expensive prices for DCA people like you. How about this once-in-70-year crash? 24 months? It’s once-in-70-year ok. Normal bears did not last that long.

Common sense would tell you that if you continue to buy high-priced (bull market) units for much longer time than low-priced units, this crap strategy doesn’t work in the long run.

Most markets exhibit the same pattern over the long run: UP! This long term market trend works against DCA aka RSP. I think I have teach you a lot for free already. I am not asking you for any return but just a simple request: stop soiling people’s decent blogs with your rubbish and ‘opinions’. You are indeed embarrasing yourself. Martin, right?

I have all the chartings and data to prove my points. Want them? Read BT one of these days.. 🙂

What do you have to back your nonsense? You read them somewhere in the newspaper is it? People said so then you agree without checking it out? hahaha… Tak boleh tahan this kind of ‘smart’ people…

ReplyChill it guys.

Let’s not get too personal.

Everyone is entitled to his/her own point of views. If they are different, sometimes we just have to agree to disagree. 🙂

Personally, I don’t like ILPs as I have to take on the investment risk. I don’t like to introduce additional risk parameter into my insurance (which I’m using to manage risks). Furthermore, I would be better off doing a buy term invest the rest strategy rather than use an ILP.

For WL, most of the upside is taken away from me but I can accept that as most of the downside is also taken away from me.

Lastly, I do think RCA has its own merits.

ReplyInstead of replying me in the manner characteristic of a salesman whose raw nerve has been poked by my exposition please do rebut my points about regular ILPs and WL. If you know much about them why don’t you share and tell us which of the points are not true. Stop hiding behind the “every cleint has a different need staff or every product has its purpose” They cannot justify your recommendation. Did FAA say or recognise that this is acceptable reason for recommendation? I don’t know where have you leanred that DCA works ” over the short term” . Gosh.. you should prove this or have your finding published in the finance of the Institute of CFA. It would make William Sharpe blush. So much for your knowledge of finance…is it a wonder why you fear ILPs? and love WL?

You are right I have resentment for rogue agents and salesmen masquerading as financial experts. I don’t have bad experience. I have seen rogue salesmen at work. You are in fact more dangerous with half baked knowledge even on insurance. You sell and peddle what suits you right? Please stop the crap about WL for lifetime coverage.

The Watchman,

While there’s a bit of truth in your posts, I really do not think you are being objective. It seems to me that you have had some bad experience with agent/advisor or you were agent/advisor before but couldn’t make it/ dropped out or that sort. From your posts I can sense much resentment and bitterness about the industry. Cheer up man.

On regular ILP, you may really need to research more before you comment. Half-baked knowledge is sometimes more dangerous than no knowledge.

ReplyBoth regular ILPs and WL are crap products that rip off consumers without in return compensate them.

But between the devil and the deep blue sea I prefer regular ILPs because of

1.flexibility

2. you can turn it into what ever you want; eg. into limited payment WL, WL, endowment or term

3.no need to borrow and pay hefty AH Long San interest rate

4.you can adjust sum assure and investment amount as and when you like

5.there is no one size fits all portfolio where tom dick and harry all dump into one pot

6

7..

Wholelife? limited WL.. they are cast in stone in favour of the insurers..once in you are locked for life and at the mercy of the insurer…non transparent.. both the company nor the agents disclose them.. when the company makes more money they say they keep some for you for smoothing their Axx. etc etc

Verdict?… don’t touch these scam products with a 20 foot pole

ReplyHi watchman,

I think ILPs can be a walking time bomb if the consumer does not know what he has bought.

I have seen a few cases of risk adverse people thinking they have bought a low risk insurance product.

They do not know they are subjected to the investment risk (and oh yes, their portfolio is the typical china and india funds). They get a shock when I tell them about it.

ReplyGarrett,

I agree with your view about that Tan. He and his loyal supporters condemn all agents and advisors and the whole insurance industry indiscriminately. For someone who bites the hand that feeds him, that tells something about his character. 🙂

ReplySW:

I seriuosly think you may want to consider talking to an FA cos being an tied agent you face product and many other limitations. It’ll shock you when you do a comparison and see the premium/benefits differential. I believe your company does not carry all types of products too (eg Eldershield supplement is only available at GE, NTUC and Aviva. Disability income is only sold by GE and Aviva. Only 5 insurers have private shield plans). To help your clients put in place a comprehensive insurance portfolio, you need these different plans). P/S: I have no issue with most insurance plans, with the exception of regular premium ILP. It’s a no-no. I don’t find it serving any purpose, both from protection and investment point of view. Dollar cost averaging only works over the short term, and does not really work over the long run.

Garrett:

Finally, I find someone who agrees that regular ILP is a no-no. Really crap product first brought into S’pore by Prudential. “..there is no justification of using Regular Premium ILP in any portfolio, regardless of ‘client type’.”

ReplyAs an advisor, I learn that I should not impose my set of values and beliefs on clients. I have met enough clients to know that some really cannot tolerate the slightest risk. They will not be able to sleep well if you tell them that they may lose some of their capital. This woud pose risk to their health. This group of people are happy with fixed deposit rates of less than 1%. They want everything guaranteed. What would you do if you were the advisor? Explaining to them that fixed deposits are safe for short term but very risky over the long run as inflation erodes away purchasing power? Or telling them that equities, despite their volatility, would outperform all other asset classes in the long term? We know which work better for the clients, but if they are really not into investment, I think we just need to find alternatives to improve their financial positions.

Many people do not have access to product info or possess the knowledge but thought they are the experts. There are always two sides to a coin. Many of them criticised NTUC’s Capital Plus plans being a sucker’s product which locked people’s money for 1 or 2 years but only paid say a guaranteed return of around 2% p.a. But to those who are extremely risk averse and receive only 0.7% p.a. for a 2-year term FD, the guaranteed 2% p.a. offered by NTUC Income is really a god-send plan.

To each its own. As in all things, there are some good there are some bad. Don’t condemn every insurance product or every advisor you encounter. Some advisors, though belong to the minority, are earning an honest living with clients’ interest at heart. Don’t be like that bitter old man. Really tak boleh tahan.. 🙂

Reply“every client has different needs” and every product has its purpose” is usually the mantra of salesmen and insurance agents and they use them to justify pushing high commission products .

I agree to some degree provided the agents conduct a fact find and need analysis and the outcome points to these products as the MOST suitable to meet the needs.

I define risky products as products that cannot meet your goals adequately. So is WL like vivolife risky? To a rich man it may not because after forking out a large sum of money to pay the premium his other needs and resources are not affected. To the ordinary folks the premium paid for vivolife can buy enough insurance to cover the 4 areas of their risks.

Someone mentioned about legacy. Is this a priority? But you mean the legacy to take care of one’s family due to premature death then term is the best vehicle and not WL, right?

$47K death claim to take care of what? This is from LIA first half year report for 2010. Throw the deceased into the sea and don’t spend a cent from the claim how long can the $47K last?

Why so low claim? it is because generally consumers are sold low coverage because of WL which they cannot afford more.Although low coverage with WL the agents make more commission than selling term with the same premium.

There was this story of a rookie agent who started out enthusiatically about his new role and before long he sold a $30K sum assured WL to a friend. He was very elated and he thought to himself why didn’t he see the great potential of this quick money making business earlier.To cut the story short. 3 months later this friend met with an accident and died and left a homemaker wife and 2 young children. When he brought the chegue to the wake and seeing the bereaved wife with her children clinging to her this agent felt a sense of guilt that in his hand was only a $30K chegue. What could the $30K do for them? In fact , he had thought about selling term to his friend but the commission got the better of him. He could have sold $600K term with the same premium but his conscience wasn’t with him that day.

He was so distraught about what happened and that he had led down a friend’s family he quit the industry and never returned.

The moral of this story is do what is right.

Actually, WL plans do not actually pays the highest (rate of) commissions in all cases.

One particular WL plan pays out 40% (of annual premium), 12%, 5%, 5%, 5%, 5% commission for the first six years.

One term plan pays out 10% for the life of the plan. Over 20 years, that can work out to 200%.

Another term plan pays out around 50%, 25%, 25% for three years.

Yet another term plan pays out 45% for one year. On the other extreme, there’s a term plan that pays out more than 100% in commission for the first year.

If a person decides to buy a higher coverage using term paying the same premium as he would have with a WL, the commissions might be similar (eg 100k WL, $1mil term). However, the work to get a $1 mil plan incepted would be a lot more as the client would need to go for medical underwriting, etc. There’s also a greater chance of failure.

However, if he decides to buy the same amount coverage using term, then the commissions would be very different (eg 100k WL, 100k term).

ReplyLioninvestor did a good job in an unbiased analysis and I really don’t think it warrants any bashing down.

There are many people who are risk averse. Such people do not want to “invest the rest”. You cannot force people to buy stock, unit trusts, funds if they do not wish to. There are also people who want to cover beyond retirement to “leave something behind” using insurance. Not everyone just want to cover only for the period where their child(ren) are growing up. What if they want to leave something for their spouse and not depend on the child(ren) support ?

By pushing term insurance only, this is called “product pushing”. Have anyone heard before? I don’t know what the agenda is but it is not good for consumers.

Most good long-term advisors would advise consumers to adopt a balanced view of things rather than putting all the eggs in a basket and buy term insurance only and think that: “my insurances needs are all addressed, I have enough”. As you are aware, needs and circumstances change with time, and so does one’s portfolio.

Nobody can tell you when you will get sick, disabled or die. Statistics provide a reference but it cannot even serve as an accurate predictor. I don’t have all the answers, but I find whole life, term, ILPs and endowments all have their own particular relevance in a person’s insurance portfolio. Just as stocks, unit trusts, gold, fixed deposits in a person’s investment portfolio. The product combination may differ from person to person, depending on his or her circumstances, needs and wants.

And, for your info, there is no need to hide behind “caveat emptor” when you can handle situations with an objective and balanced approach.

ReplyIndeed, I’m with Lion on this particular post. TKL reply was hardly justified. The old “he’s an insurance agent so he has an vested interest” argument generally holds true for most arguments by virtue that they are so weak and nonsensical, but I think Lion’s post is valid on using WL as a possible alternative to people who are extremely conservative investors, in which BTIR returns have a strong chance of underperforming WL. In fact, TKL didn’t publish my reply, and honestly his more recent posts and more recent advice has been getting from bad to worse.

On the flip side, I also do think the “each client is different” is getting a bid stale. Sorry to be blunt, but that is just a cliche which I translate to “each client has a different way to be milked”. Some insurance products are just crap. That’s a fact. For example, there is no justification of using Regular Premium ILP in any portfolio, regardless of “client type”. I believe any ethical IFA will agree with my assessment. Of course, if anyone disagree please feel free to provide an example. Other products like WL are more grey and may depend more on the client investment portfolio.

The case of WL vs BTIR (Buy Term and Invest the Rest) is very straightforward. Either you purchase WL or BTIR. Anything else is just excuses. Excuses from other people who have commented here like “client cannot manage money and will stop RSP-ing due market down turn” and “client does not want to invest in stocks”.

My response is that it is the responsibility of the IFA to educate clients properly on managing investments. If clients do not want to invest in a market downturn or refuses to invest in stocks, it more often means that the IFA has not attempted to sufficiently educate the client properly. Oh yeah… but educating clients is free work without any pay so why bother right?

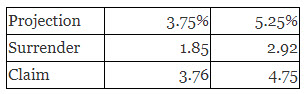

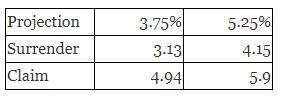

In any case, I still think Lion’s analysis show that WL is still not suitable for the majority of people. Given that NTUC Vivolife fund (according to the BI published in 2008) is invested in 30/70 stock/bond portfolio, I seriously doubt it can meet the 5.25% projections. A 3.75% projection is more likely, and BTIR will outperform WL if annualized returns are over 5%. Given that this case study is a young person, even conservative investors are likely to annualize 5% over the long term using a 60/40 stock/bond portfolio

ReplyHi Garrett,

Thanks for your comments.

I use the term “each client is different” to mean each client have their own needs which has to be met with different (combination of) products.

Of course, the products would still have to be decent and not crap products.

With regards to the performance of the par funds, I think there is still a chance for a 30-70 portfolio to obtain 5.25% returns. It depends on how well it is managed.

For example, even buying Capitaland bonds already gives an almost guaranteed return of 4.3%. IF the entire fixed income has a 4% yield-to-maturity, then the equity portion will need to return about 6.5%.

The only problem is that we will only know the actual performance after it has been delivered.

FYI, the end 2009 allocation for Vivolife par fund is

28% equity

58% fixed income

4% loans

6% property

6% cash/others

Hi,

if you are comparing endowment Par plan with Capland bond may not be that appropriate because one offer protection but the other do not.

I feel that one should not stress too much on the WL 3.75% or 5.25% return esp initially you are buying it for protection purpose.

cheers

ReplyHi Daniel,

I was not comparing the par plan with Capitaland bond actually. I was saying the a 30-70 allocation par plan has a good chance of meeting the 5.25% projection if it could invest in things like 4.3% Capitaland bonds.

ReplyWe mustn’t use this overly used excuse ,”each client has different need and circumstances’ to peddle WL product . There is no reasonable basis and not acceptable by FAA. This excuse often results in under insurance because often the clients cannot afford to buy the full coverage as needed. This time the insurance agents’ excuse is ‘the clients want only WL with cash value” and term products don’t refund the cash … What happens then? This results in gap, shortfall. Is this short fall created by the agents or really by the clients? It is actually the agents trying to create future opportunities disguised as ‘review’. Is there financial counseling? No…it is easier and safer to pander to the wants of the customers than risking losing the case, right? Is this ‘independent financial advising? How would you answer to the relatives of the clients if something should happen to the clients shortly after buying the little bit of sum assured as uncovered by your need analysis? I guess the agents will be hiding behind Caveat Emptor for safety.

ReplyI think the whole industry is the way it is due to the insurers, agents and consumers. It is a relationship between insurer-agent and consumers, but one part is going to benefit more than other.

If an agent is completely 100% for his client, how many clients must he procure to have a sustainable income? Yes, it’s the whole talk about commission again. Term plans can be a fraction of a whole life plan cost. Similarly, the agent’s remuneration is similarly fractioned. If it’s something like one-fifth, or even one-tenth, and an agent needs an arbitrary 8 clients to earn a living per month, would that not mean he will need 40, even 80 clients per month?

Would he be able to find that many? Should he also rebate all the commissions he earn just to be completely altruistic? Would his service and commitment to his clients suffer as a result of him having more clientele?

Some might point out that fee-based planning would be the solution to such problems, but my opinion is that it’s not really suited locally, at least for now. Insurance here is sold, not bought. And I suppose there is no stopping unethical planners to whittle away the hours just to charge a higher fee.

At the same time there are many bad agents who will care solely about self-interest and misrepresent and mis-sell the products that they carry.

My personal take on the issue is that, in the relationship between insurer-agent and consumer, benefit has to be shared. If we quantify benefit as 5 units, how are these units going to be shared in this two-way relationship? 3-2, 4-1, 5-0?

I’m an agent, and sometimes I get 3-2 my way. Sometimes I get 3-2 against my favour, nearing 4-1.

To declare it: I have sold life plans, savings plans, ILPs, after doing fact finding with the person in question. I do believe each have their own uses in each person’s portfolio.

After reading so many comments that vilify people of my profession and also the products that I typically sell, I have spent some time aggrieving over whether I am doing the upmost best for my clients. It has affected my work until it has reached a standstill and my boss has issued an ultimatum for me to produce or quit, for both his sake, and more importantly my own since I wouldn’t have much to earn if I were to continue this state.

I love this job, I love my clients. I just felt the need to write this out and I don’t think it will change people’s thoughts, but it’s my own.

ReplyI agree with Shanne that it is an individual choice.

There are reasons why whole life will suit some people and why term may suit others. There are no problems with the products.

The products are with the people who are not open-minded enough. It is like “two legs bad”, “four legs good”, kind of thinking.

People like them just want to bash the whole life product and promote term insurance. It is totally one-sided.

To be objective, it is good to both the good and bad sides of things and achieve a balanced view.

Reply“At the end of the day, it is not about only about whether whole life or term is better. It is about whether you can cover all your needs based on your budget.”

Buying insurance is about that and not about saving . Buying WL deprives you of the much needed coverage . The problem is insurance agents don’t care. They care for the commission and NEVER stress the importance of coverage but they rationlise with lots of argument to justify selling you the products. As a result Singaporeans are under insured.

The recent LIA report is frightening. Although sales went up but sum assured sold still remained around the $50k which has been the past figures. The claim also never went beyond the $50K.The poor victims are the consumers. What can they do with this miserable sum?

Worse LIA claimed that there were more cases with full and partial fact find and in fact went up to 72% but this didn’t result in bigger sum assured sold.. How come? The answer is something is amiss and there might be a lot of plum pudding going on in the insurance companies. There is a conspiracy .MAS should investigate why the top down fair dealing outcome guidelines isn’t working.

Fake fact find with inappropriate recommendation and conflict of interest..Product pushing has gone up and this explains the increase in sale. Alas these figures attest to more victims of insurance agents. Wholelife, vivolife were pushed without the regard of the needs of the customers. In ntuc, they mastered the skill of selling and pushing vivolife, as good as the snakeoil , koyok salesmen at Waterloo Street.

http://tankinlian.blogspot.com/2010/08/whole-life-policy.html

This is what I read from Tan Kin Lian’s blog about your post. Do you have anything to say?

ReplyHi Vincent,

With all due respect, Mr Tan is entitled to his own views but he makes sweeping statements that are uncalled for (2nd and 3rd sentence).

FYI, I’m financially stable currently and do not need to rely on commissions for my living. So that is the last thing that I look at for any of my recommendations.

In my post, I provide facts (with some calculations) and my own opinion.

Readers of my blog are intelligent enough to read and form their own opinion of what is best for themselves.

Again, this is not a matter of whether WL or term is better but what is the most holistic approach for you?

Different people have different concerns that needs to be addressed and imo, you can’t prescribe a standard formula that is applicable to all.

ReplyWell said.

Either Term or whole life both have their strong and weakness. It really depend on individual’s need and objective.

If you are financially savvy, you should be able to know which suits you.

But if you are not savvy and not covered yet, its better to speak to a financial adviser asap.

I believe a saying,

the best investment is not the one that give you the highest return but to provide you with the money when you really need it.

Cheers

ReplyHi Martin,

this is a great post.

I re-posted on my blog and added comments on issue of convertibility for those who change their mind (from term to whole life midway; and those on tight budget).

http://www.eemintheifa.com/2010/08/whole-life-vs-term-critical-illness.html

Cheers!

ReplyHi Ee Min,

Probably just need to be careful about whether the CI rider is convertible as well.

Anyway, I think a guaranteed renewal term plan might be another option for those with tight budget. They can choose a short term, and decide on what they want later.

ReplyHi Martin, I know where you are coming from. And that is a concern I share too. There used to have 2 insurers who provide convertibility for CI rider. Now left only one.

Of cse, if the insured is still in good health (should he change his mind from term to WL subsequently), there’s no stopping him from shopping around for the most value for $ WL-CI plan at that point.

ReplyHi Lion investor,

Please correct my understanding on the total payout amount. I did some calculation however i am not able to get the same amount

exp:

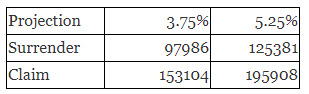

PMT:1244 N:41 i/yr:3.13% FV:100880.343 instead of 97,986 ?

PMT:1644 N:41 i/yr:3.76% FV:154859.77 instead of 153104 ?

Is the differences result after tax ?

Thanks

Regards

Andy

Hi Martin,

I read your posts and generally find them well written and informative. But your analysis on this WL vs Buy Term and Invest the Difference is fundamentally flawed. Why do you care about the surrender value if you are buying a CI WL plan (in this case Vivolife)? I thought it’s meant to protect CI or death for a lifetime and for claim purpose? If you buy with the intention to surrender later, then I would say forget about all bundled plans, or all insurance plans for that matter.

On your point on ‘Buy Term and Invest the Difference’, do you really think S’poreans have the discipline to invest the difference in the first place, not to mention 40 years? If you have seen enough clients, you will know that most quit their RSPs since 2008 when prices were low. They are not back even now. They will only start buying when STI is nearing 3,800 again. Do you really think this will work for most people? They will spend the difference instead. I am not an advocate of bundled products, especially regular ILPs. But when it comes to lifetime CI protection, certain bundled plans are a better solution than term insurance. We must appreciate the fact the each client’s needs and situation are different. Importantly, we must be competent and know what we are doing. Doing the right thing right is of utmost importance. 🙂

ReplyHi Shanne,

the surrender value is only there for completeness.

See point 1) which I had highlighted in bold.

Reply