Leave a Comment:

14 comments

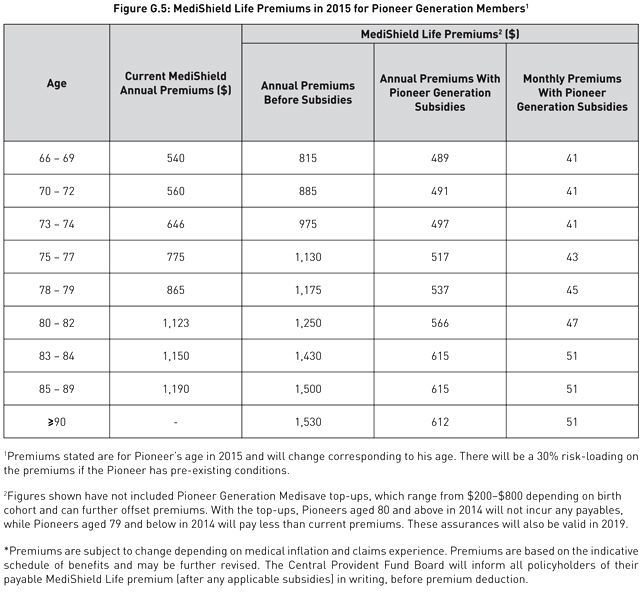

Would Means Testing apply for the Medishield subsidy for the pioneer generation ?

ReplyYou can relax … answer is nope.

However means-testing still applies for B2/C ward billing for pioneers.

Unless govt changes policy going forward.

ReplyDear BC,

It should apply to everyone unless the government decides to change it. (referring to the Means Testing on staying in B2 or C wards)

Since most of them would have stopped working by now, it will impact mainly those who stay in private properties.

ReplyHi Martin,

I am currently with AIA IP paying a premium of 518/annum this year, took my agent to task for that whopping increase…haha. What should i look into prior to deciding whether to switch back to Medishield Life OR stay with current IP?

ReplyDear Lim,

Like I mentioned in my earlier post http://www.martinlee.sg/time-drop-integrated-shield-plan/ there are many things to consider.

Look out for my upcoming article next week, which I will try to address all the factors.

ReplyHi Lim

I am in a similar situation as you.

In 2013, I asked Aviva to give me a breakdown on the money deducted.

Below is the extract:

Premium of Integrated Shield Portion = ($800.00 – $220.00) x 90% = $522.00

Total Renewal Premium = Basic Shield Premium + Integrated Shield Premium = $220.00 + $522.00 = $742.00

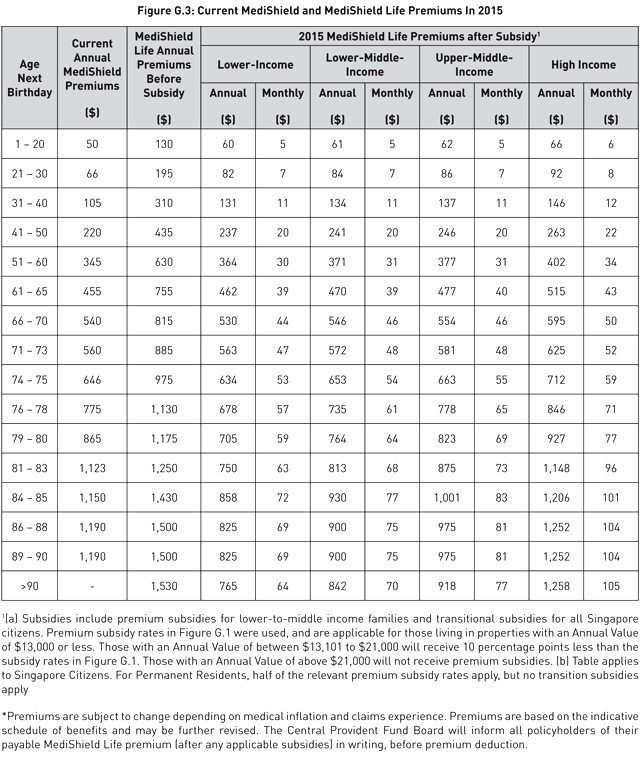

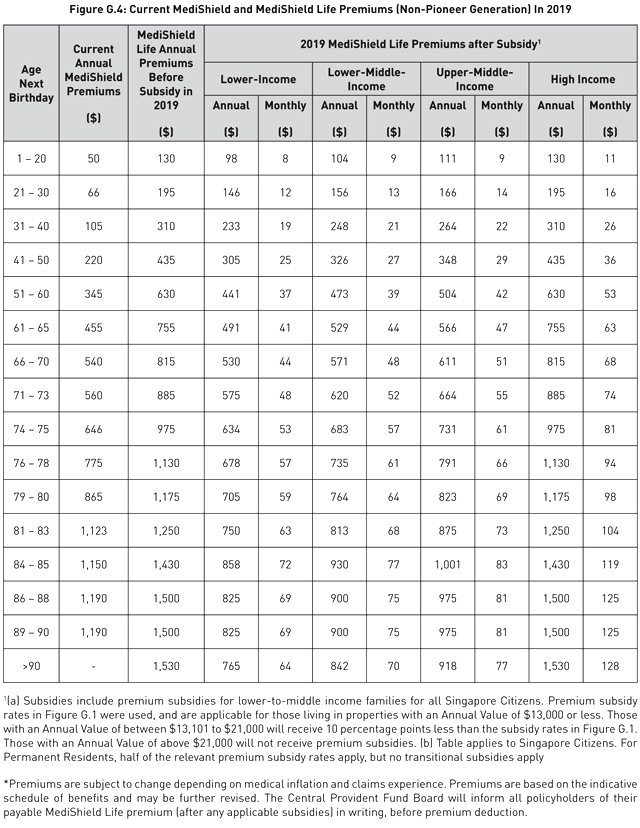

Assuming cost of IP remains the same and to make calculations simple, I am expected to pay $263 + $522 in 2015, $630 + $522 = $1152 in 2019 !

There is a cap in the contribution of Medisave A/C. Once the money in the a/c runs low especially when one is not working, how can the payment of premiums including IP be sustainable?

Also, we are looking at premiums till 2019/2020, what’s next?

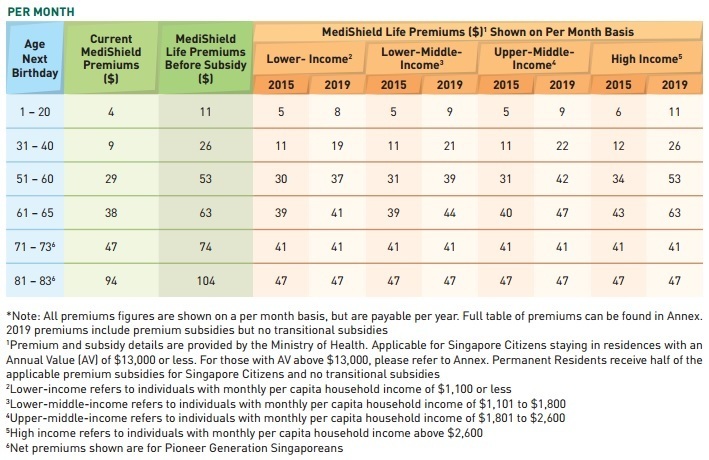

ReplyAlready told you all. 2X to 3X increase for majority of people (majority of population still below 55 for now). Inter-generational transfer of wealth whereby the younger people from 0 to 40 have to pay 3X or more. The only surprise for me was the 0-20 age group also not spared — I guess the authorities figured that parents will still be willing to pay for their own children’s protection.

The 40s and 50s age group is basically a doubling of premiums. And then the authorities try to soften the increase for those 60++.

BTW, don’t forget these new premiums are based on medical costs & claims as of 2013. By the time the subsidies are withdrawn by 2019, the premiums across-the-board would have been raised. In fact, I think they will need to review & increase the premiums around 2017.

Premiums for healthcare insurance have been undergoing review & increase every 2-3 years. This has been happening especially since the last inflation spikes in 2007/2008. A major contributor to medical inflation has been the govt’s unwillingness to hard-cap medical costs & prices, as it will affect S’pore’s attractiveness as biomedical & pharmaceutical hub.

As for whether to give up private IP, need to wait for actual confirmation of revised premiums. But I fully expect it to be very bad.

ReplyDear xyz,

I expect the premiums for the IP to increase by the same or similar increase for Medishield Life.

For the plans that cover private hospital, the premiums might increase by even more.

ReplyHello Martin

Could you share some information on the column “current annual medishield premiums”? It seems odd. Each insurer has different packages with different premiums. How are the numbers derived?

Thanks for sharing!

ReplyDear Herny,

The current Medishield premiums refer to the current premiums charged by Medishield.

This is the same paid by everyone no matter which private integrated shield plan they are under.

For example, it is $105 for the 31-40 age group.

If your private plan charges you $200, they will keep $95 and pass $105 to Medishield.

ReplyHello Martin

That is very interesting. I never knew insurers could ride piggy back on

another and apportion the premiums…

I suppose there is no point in underwriting a brand new policy when one is already in operation.

Thanks for the information, appreciate it.

ReplyThanks Martin for sharing.

It is really OMG and expected 🙁

I would be expected to pay $263 but in 2019, my annual premium would almost triple to $630 as I will enter into the next age band.

This is excluding the portion from IP.

How am I going to bite this bullet?

Those without stable job and low pay e.g. daily rated or low-level service jobs, will be even worse shape.

There are almost 1 million Sinkie workers getting $1800 or less each month (and this $1.8K is gross salary including all year-end bonuses and OT). This is the number getting Workfare as a result of even govt admitting they’re not earning enough to survive properly in S’pore. Of these 1 million, 30% of them are earning $1000 or less.

Sure they get subsidies, but even paying $441 instead of the higher $630 is already a life-and-death struggle for them. Many will have to beg, borrow, steal to pay cash because their salary is barely sufficient to build up money in their CPF and Medisave. Especially if their jobs and salaries are irregular types, hire-and-fire environment, paid only if called on duty.

Reply